Notes:-

Make Tax Deductible Donation under Section 80G

Donations to Change Maker Alliance Trust Charity will be eligible for 50% tax exemption under Section 80G of Income Tax Act.Indian Donors will get instant Tax Exemption Receipts their email address.

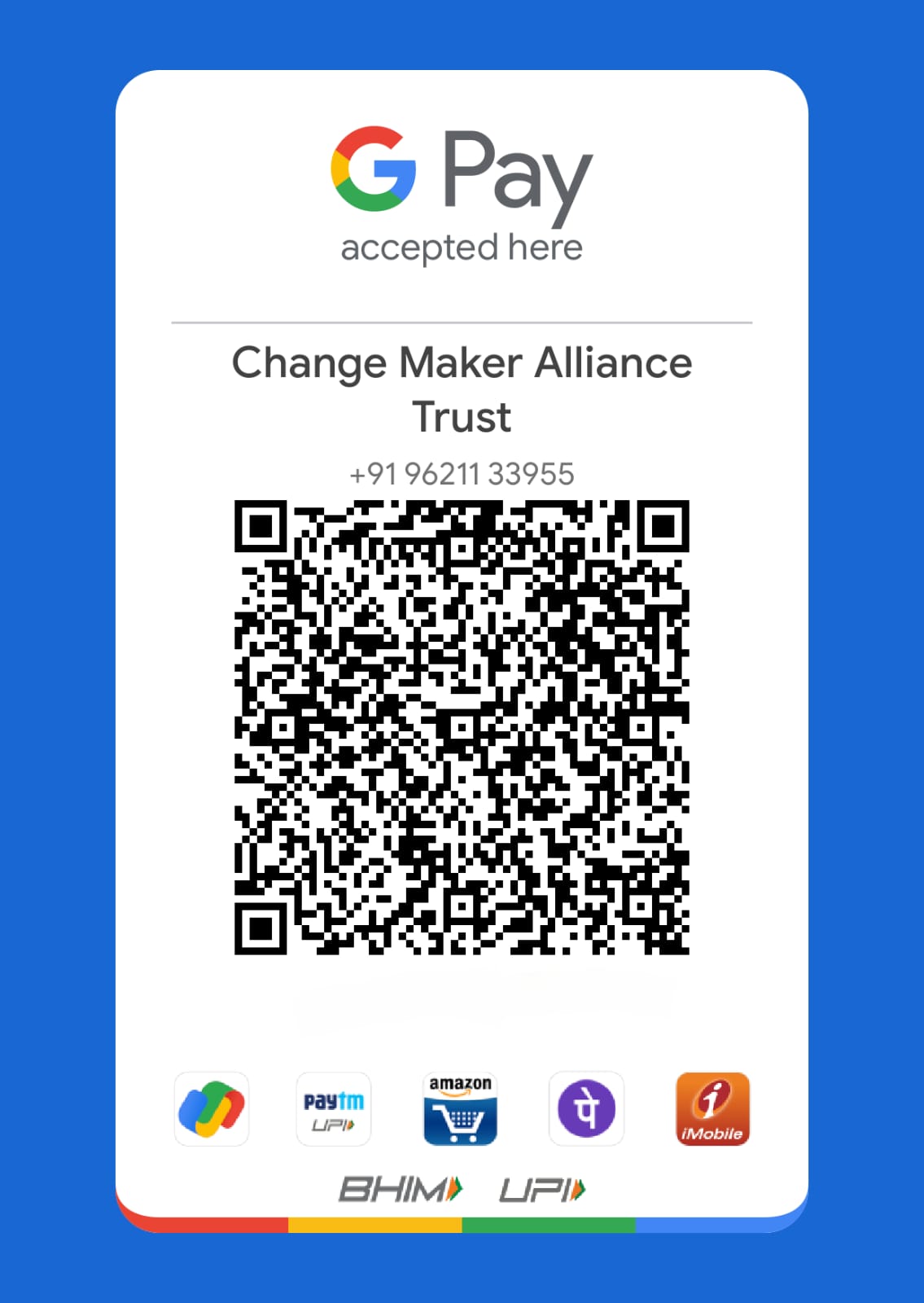

Please fill the form to make donation online

FAQ. Your Questions On Sec. 80G Answered.

Income tax department allows reducing of the taxable income of the taxpayer in case the taxpayer makes certain investments or eligible expenditures allowed under Chapter VI A.

Another way you can save tax while doing some good work is by using the deductions available under Section 80G of Income Tax Act. Section 80G of the I-T Act allows donations made to specified relief funds and charitable institutions as a deduction from gross total income before arriving at taxable income.

Eligibility Of Individuals And NGOs Under Section 80G

Any fund or institution which satisfies the conditions mentioned in Section 80G(5) is eligible to receive donations under section 80G.You can easily check the registration of trust/ organization through the Income Tax Website. Simply visit www.incometaxindia.gov.in & check for the trust/organization.All taxpayers (individuals/companies/Hindu Undivided Families) are eligible to make donations to charity under Section 80G

What Is The Payment Mode Of Donation For Availing The Benefit Under Section 80G?

In case you wish to claim income tax deduction benefit in respect of the amount you have donated to eligible institutions you need to adhere to the following

1. No deduction or income tax benefit shall be given for donations made in kind such as donation of clothes, food etc.

2. No tax benefit for cash donations exceeding Rs 2000 shall be allowed to the taxpayer.

3. The payment for higher amount (exceeding Rs 2000) should be made through cheque, net banking, demand draft or other banking channels.

How To Claim Deduction Under Section 80G In Income Tax Return?

For claiming deduction u/s 80G, you have to submit the following details in your Income Tax Return (ITR):

1. Full Name of the Donee Institution

2. Amount of contribution made in the corresponding financial year

3. PAN Number of Donee

4. Address of Donee

5. Phone of Donee